The tax scale needs to be more encouraging, not flatter

We’re hearing a lot right now about the wonders of reducing our tax brackets. But knocking brackets out of the tax system doesn’t really do much for Australia’s economy.

We’re looking in the wrong place. If we want to use the tax system to make Australia more productive, we need to concentrate on the ‘effective marginal tax rates’ faced by low-income people – those whose income is below A$30,000.

Here’s why – along with an explanation for that clunky piece of terminology, ‘effective marginal tax rates’ – it turns out to be important.

The simplicity dodge

The federal government has been promising for more than a year to reduce the current five income tax rates to four. The 2019–20 Budget proposes to tax you at 30% tax on every extra (marginal) dollar of income you earn between A$45,000 and A$200,000.

The government describes this as "structural reform", suggesting it’s helping to boost economic output.

It isn’t.

There’s no credible evidence anywhere on the planet that I’m aware to suggest that reducing tax rates from five to four will benefit the nation, or affect anyone’s outlook on their economic activity.

These days most people work out their tax from some sort of online calculator, or see it on their pay advice, or have it assessed quarterly by the Tax Office. No-one does it in their head, and reducing the tax rates from five to four doesn’t make the calculations much simpler anyway.

Germany, for example, has an essentially infinite number of brackets – your rate on the next dollar changes with every dollar you earn – and it seems to be doing just fine.

Bottom line: "reducing the number of income tax rates" isn’t a very important change. I am genuinely perplexed as to why anyone would think it should be.

Here’s what governments should attack instead of tax brackets

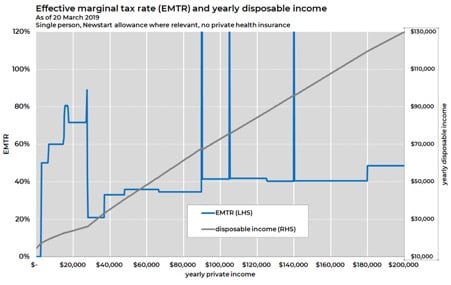

Graph: Real-world tax rates (taking welfare payments into account)

The graph above comes from retired public servant David Plunkett, who spends some of his spare time calculating what are called effective marginal tax rates, or EMTRs. These are the ‘effective’ tax rates you get when you take into account that welfare recipients both start paying taxes and lose welfare benefits as they move into work. The ‘marginal’ refers to the tax on each extra dollar of income.

This graph may seem a bit scary, but it’s actually quite simple. The blue line shows the EMTRs a single person pays on their next dollar at various incomes, assuming they earn Newstart (the Australian government’s unemployment benefit) where they’re eligible.

In a progressive tax system, you might expect this line to be lower over on the left-hand side, where low-income earners are. But here’s a weird thing: the left-hand side is where the graph is highest. What’s going on?

Remember, the graph is showing effective rates. These are real-world rates, which are much more complicated than politicians’ talk of just three or four brackets.

As the graph suggests, a single person moving from Newstart (the dole) into work can face an EMTR of more than 70%. That’s because as well as losing some of each dollar to taxes, people also get welfare benefits progressively withdrawn as they earn more.

People with really high EMTRs notice them. I once worked with a new graduate who came to me one week complaining her pay packet had gone down even though she’d just had a pay rise. It turned out that her university repayments jumped at a certain income level. That had pushed her effective marginal tax rate over 100%. You can see a couple of weird spikes like that on Plunkett’s graph too.

So, a banker or computer programmer gets to keep about 53 cents in each extra dollar they earn, but a formerly unemployed 23-year-old joining the workforce for the first time gets to keep about 28 cents. You can bet our 23-year-old will notice. They may wonder why they got out of bed.

This problem matters everywhere, but it matters most in Australia because the country has such a targeted welfare system. The government withdraws welfare benefits pretty aggressively as people start earning their own money. That lowers our welfare bill effectively, but it also leaves us with high EMTRs.

We can’t make the problem of high EMTRs disappear entirely. But we can reduce it by withdrawing welfare payments more gradually in certain areas. In the process, we’ll provide effective encouragement to people to work more.

Conclusion: EMTRs

Lowering brackets and "simplifying" rates is what governments mostly do when they can. They dress it up as "structural reform", but it often isn’t that at all. It’s frequently just something governments do to make people vote for them.

We’re wasting time and energy making up stories about the benefits of reducing the number of tax brackets. If we wanted to use the tax system to make Australians more productive, we’ll concentrate on reducing EMTRs for the low-income people just entering the workforce. That’s the best bang for our tax reform buck.