Robinhood’s CEO is planting the seeds for global expansion

Robinhood CEO Vlad Tenev has built his mobile trading platform around the concept of democratizing the stock market but, by branching out into the wider world of finance, he’s leveling an even greater playing field.

Robinhood CEO Vlad Tenev has built his mobile trading platform around the concept of democratizing the stock market but, by branching out into the wider world of finance, he’s leveling an even greater playing field.

The legend of Robin Hood has persisted through the ages as an agent of equality, robbing from the rich to give to the poor. In the 21st century, one form that idea has taken is self-directed trading.

The result may not be a direct facsimile of the "rob from the rich" concept, but it’s certainly helped those with less gain a piece of some very large pies.

It was with this benevolence firmly in mind that Co-Founders Vlad Tenev and Baiju Bhatt publicly launched Robinhood, a mobile trading platform, in 2015.

The invention of the Robinhood app

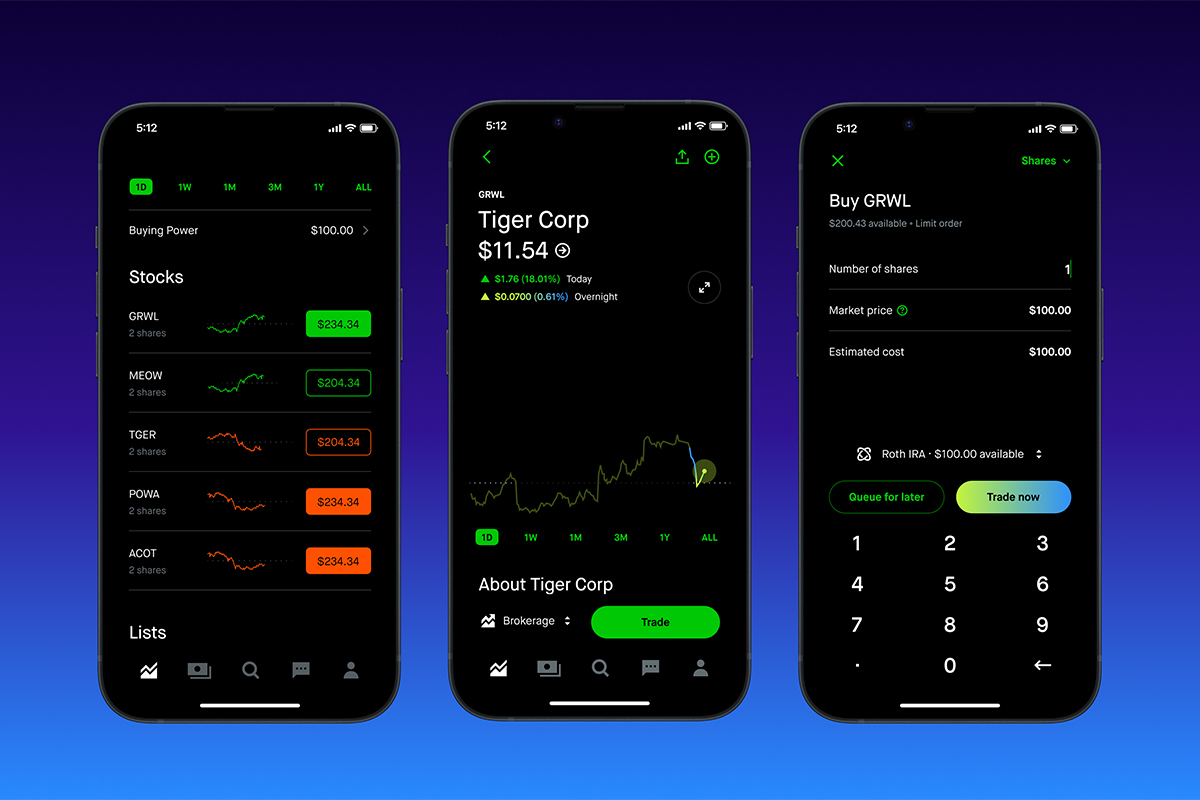

Once upon a time, the general public had to rely on brokers to make gains in the share market. With the advent of online trading platforms and apps, however, it’s easier than ever to invest. Attractive features, such as no commission fees, have helped Robinhood channel the spirit of its namesake.

According to Tenev, who remains Robinhood’s CEO, the philosophy behind the app began to take shape during the 2008 global financial crisis.

"Right now, the New York Stock Exchange is basically an event space; there’s very little actual trading going on."

"Growing up, my idea of investing in the stock market was people on the floor of a trading pit waving paper tickets," he tells The CEO Magazine. "But starting in the 2000s, the bulk of trading activity became automated and went to data centers.

"Right now, the New York Stock Exchange is basically an event space; there’s very little actual trading going on."

Most of the action remains online, a situation that offers next-generation traders, such as Tenev, ideas and opportunities beyond the realm of what was long thought possible. He and Bhatt, then Stanford roommates and classmates, joined forces to make the most of that new frontier.

"We created an enterprise company that offered tools and software for firms that wanted to get into the algorithmic trading industry."

The rise of the mobile

At the same time, the mobile juggernaut was awakening. "People used their phones for social media and photography. Our belief that this would become a first-class platform for financial services was actually contrarian at the time."

The pair made a bet that smartphones would become the primary way that people engaged with their finances. Their solution was Robinhood, at once an attempt to democratize finance and a response to the growing dissatisfaction among young people with the world’s financial system.

"There was an opportunity to bring more people into the financial system and combat the perceived exclusivity and lack of fairness that had permeated finance for a very long time."

"It was clear people were ready for a change," Tenev says. "There was an opportunity to bring more people into the financial system and combat the perceived exclusivity and lack of fairness that had permeated finance for a very long time."

Enter Robinhood, which began as a stock investment platform but has since expanded to cryptocurrency, cash management, options trading and even individual retirement accounts.

"Robinhood Retirement is the first IRA [individual retirement account] that has a built-in match," Tenev says. "While you’re saving for retirement, Robinhood can actually help incentivize that by matching your contributions up to one percent."

In the United States, the latter is usually handled by employers, making Robinhood Retirement particularly attractive to freelancers or gig economy workers.

The diversification of Robinhood

The company’s partners have made it easy to diversify its offerings, such as the Robinhood Cash Card. "We rely on partners like Galileo to do our payment processing, and that’s a very core part of allowing card transactions. It wouldn’t make sense to build that ourselves," Tenev says.

"We also work with industry leaders to fight fraud and protect our users, including Plaid and Secure, who develop innovative solutions and approaches that help us make the platform safer."

Although Robinhood is currently only available in the United States, Tenev says that’s about to change. "We have very ambitious goals to launch in the United Kingdom by the end of 2023, and then we’ll use that as a springboard to take our low-cost, easy-to-use financial experiences worldwide."

That kind of expansion is possible, thanks to Robinhood’s solid offerings and operational excellence. The latter, Tenev believes, is the foundation of everything.

"You can have a fantastic strategy but, if you’re not operationally excellent, if you don’t have investments in the brand, that harms your prospects," he says.

"We serve 23 million-plus customers, so we’re always making sure our systems and technology are robust, and we continue to make investments to make it more efficient."

"You can have a fantastic strategy but, if you’re not operationally excellent, if you don’t have investments in the brand, that harms your prospects."

Those investments include cybersecurity and customer support, which is vital to helping the kind of trading beginners Robinhood hopes to attract.

"One change we’ve made over the past six months is to focus on having accountable, single-threaded leaders behind each of our core businesses," Tenev says.

"As the company gets bigger and functions get bigger, it takes more and more coordination, so putting those resources together under strong leaders gives you more engagement, efficiency and velocity in building new things."

In times of challenge for the tech industry, as 2022 was, the ability to streamline and optimize a company’s operations in pursuit of success is key. Tenev says Robinhood did just that, and that the result is a company that can succeed in all market conditions, not just the boom times.

"The environment shifted that year, and it was a great test of leadership," he says. "Now that the economy’s a little bit tighter, being able to adapt quickly has built resilience into Robinhood, and I think that will pay off very much in the decades to come."