Staying on Top: Shaoling Qiu

For GKN Automotive China President Shaoling Qiu, the shift toward electric mobility is merely the continuation of a journey the company embarked on many years ago, putting it well ahead of the curve.

The days of noxious exhaust fumes and the ear-splitting roar of a car engine may be numbered. Electrification is changing the way we drive and the shift is gathering momentum.

It’s a transition that may spell disaster for certain players in the automotive industry, while for others, such as GKN Automotive, with its expansive global network and a near three-century legacy to boot, it presents immense opportunity.

For GKN Automotive China President Shaoling Qiu, it’s certainly an exciting time. He joined the company in 2021, fresh from a four-year stint as CEO Asia–Pacific at Thyssenkrupp Automotive, lured in part by the company’s prominence within the industry. Before that, he had worked in a number of roles in the automotive industry, including seven years as President of Dayco China.

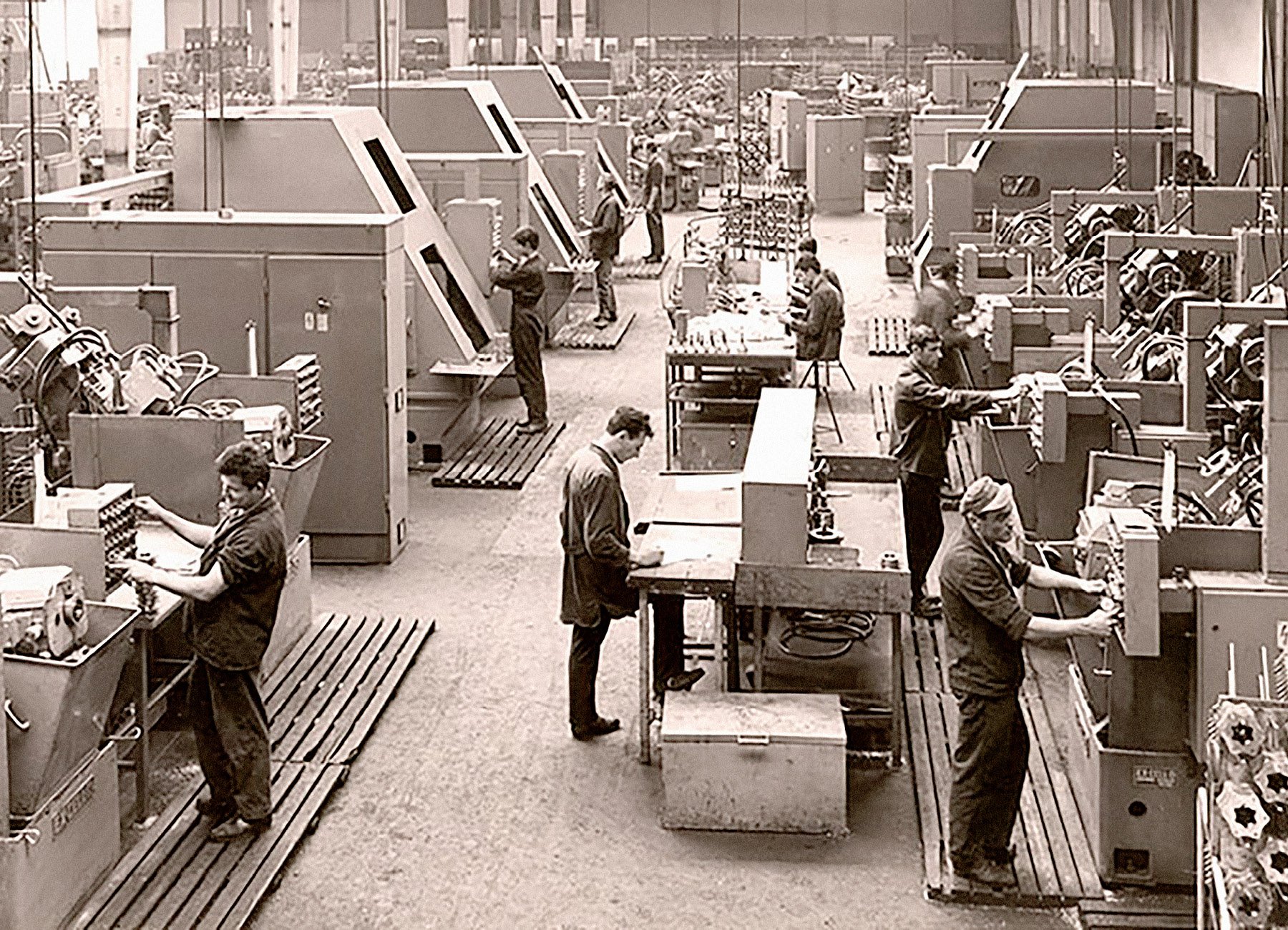

"GKN is one of the oldest automotive companies in the world – our legacy dates back almost 270 years," he tells The CEO Magazine. "It started from a small iron works and is now becoming the biggest driveline supplier in the world."

The company was founded in the UK and now has more than 25,000 staff members across 47 manufacturing facilities and six technology centers in 17 countries.

Globally, the company has almost 40 percent market share for drivelines, 30 percent of market share for driving axles and is a global technology leader in eAxles, he adds. Those numbers are even higher within China, the world’s largest car market, thanks to GKN Driveline’s joint venture with Huayu Automotive Systems Company Limited (formerly Shanghai Automotive Industry Corporation), Shanghai GKN HUAYU Driveline Systems (SDS).

GKN is one of the oldest automotive companies in the world – our legacy dates back almost 270 years.

Initially inked in 1988, the tie-up represented the first automotive industry component manufacturing joint venture in the country, with GKN the first major foreign automotive supplier to invest in China. The joint venture also saw the 2018 establishment of a technical center in Shanghai’s Kangqiao suburb specializing in research and development for its constant-velocity (CV) joint, all-wheel drive (AWD) and eDrive systems.

SDS now holds around half of the entire Chinese market for sideshafts, propshafts and driving axles, according to Qiu.

Beyond this solid pedigree, Qiu explains the position also offered him expanded scope, for while he has responsibility for the company’s operations in Greater China, as a member of the global executive team of just 10 people, he also has a say in important global decisions.

EV evolution

This step up comes as a period of intense industry upheaval is underway as electric vehicles (EVs) progressively take center stage. However, this technological shift is not overly problematic for GKN, according to Qiu.

"The new electrical vehicles still need the sideshaft," he explains. "It’s actually a favorable impact for us because all the new electrical vehicles need sideshaft products of a higher quality standard."

GKN’s early entry into the eDrive market also stands it in good stead for the changes that are afoot. Its three-in-one system includes the electric motor, inverter and eAxle reduction gearbox within a single housing. It also offers a two-in-one combination system or single modules and components.

Last year, it unveiled a next-generation inverter using 800-volt technology, enabling faster charging times, increased vehicle range and enhanced performance.

We entered this market almost 20 years ago, and we have already delivered more than 2.5 million vehicles.

"We entered this market almost 20 years ago, and we have already delivered more than 2.5 million vehicles into our system. We are one of the technology leaders in this area," Qiu says.

According to forecasts, production of electric and hybrid vehicles in China will rocket by more than 200 percent by 2025, taking it to more than 14 million vehicles annually. Meanwhile, GKN expects SDS’ eDrive production to exceed one million units per year within the same time frame.

With demand set to steeply rise, Qiu is optimistic about the prospects for GKN, but also acknowledges the increasing competition in this area.

"A lot of suppliers have entered this market. Most of the original equipment manufacturers plan to make these eDrive systems in-house because the capacity of the transmission and the internal combustion engine have to be transferred to the new technology," he reveals.

"But we have already accumulated a lot of know-how and experience for this system. In the next three-to-five years, we will continue to invest in this arena and grow this business, finding a good balance without really sacrificing our profitability."

Driving for Efficiency

A partnership with the Jaguar TCS Racing Formula E team has been helping GKN Automotive fast-track the development of next-generation eDrive technologies since 2017.

GKN Automotive has assisted Jaguar TCS Racing in the development of the electric powertrain for Jaguar’s I-TYPE 6 car, by collaborating on advanced powertrain cooling as well as software development, testing and validation. Last year, GKN Automotive had one of its software engineers integrated into Jaguar’s team.

GKN’s relationship with Jaguar dates back to 1935, when it supplied driveline technology to the first SS Jaguar saloon. Now, GKN Automotive technology can be found in every Jaguar model on the market, including high-performance CV jointed sideshafts, propshafts, intelligent AWD systems and electronic active differentials.

A positive approach

Even the trials of the COVID-19 pandemic haven’t tempered GKN’s momentum, instead acting to strengthen its supply chain. Semiconductor shortages initially impacted the China market, with the lockdown also creating significant disruptions. However, the company didn’t simply lie down and take it.

"Our supply chain is definitely more robust after this pandemic era. We really put a lot of effort into our supply chain management," Qiu confirms.

GKN redeployed staff to areas of the business that required additional support, and maintained 100 percent on-time deliveries to its customers despite the mounting pressures.

On top of this "great achievement", the company has focused on discussions and negotiations with its supply chain to help mitigate the costs associated with market volatility over the past three years.

Our supply chain is definitely more robust after this pandemic era.

"At the same time, we also discussed fairly cost-sharing any increases with our customers," he says.

It’s a two-way street. Evolving customer requirements have also prompted GKN to ramp up its sustainability efforts, which were already high on its agenda. The company invests heavily in ESG activities, improving energy use and incorporating green energy into its operation.

"We also deploy ESG targets and KPIs to our supply chain to really focus on ESG activities," Qiu says. "Over on the other side, we are also switching more and more of our customer base to the new electrical energy markets."

Along with so many changes has also come an evolution in Qiu’s leadership style.

"I think the one thing I have learned in the past two years is to try and step back a little bit and think more about strategy," he reflects. "Also, to spend more time observing and evaluating talents, and really putting the right people in the right position. And it’s working very well."

Sustainable Revolution

GKN Automotive launched its sustainability strategy in 2021, creating a "new framework" that would help coordinate its ongoing sustainability efforts.

Aligned with the United Nations Sustainable Development Goals, it is the result of a long process of engagement with key stakeholders and focuses on four main pillars: people, climate action, responsible sourcing and impact. These structure how the company works with its people, customers and suppliers, as well as with the communities in which it operates.

It is in the process of developing its net zero transition plan, expected to be unveiled this year, but it is already working to reduce its energy consumption along with its production of carbon emissions.

"By decarbonizing our products and operations through innovation, resource efficiency and waste management, we can in turn help our customers reduce their own emissions," the company states.

Culture shift

The pandemic stoked the need for a cultural reset, with emphasis subsequently placed on retaining talent, ensuring employee safety from a physical standpoint as well as a mental one.

"We did really spend a lot of time in order to offer a program of employee care," Qiu recalls. "In the most difficult times, for example, the lockdown in Shanghai, we managed to support the lives of our employees in a lot of different ways, ensuring they had the supplies they needed."

We need to empower young talent more rather than engage too much in the day-to-day operations ourselves.

These efforts were greatly appreciated by GKN’s people and reinforced its mission to establish a positive, fair and honest workplace through its culture, values and code of conduct. Its company values are: driven; ingenious; principled; and collaborative. Qiu believes that persistence is also key to driving performance.

All combined, they are commitments that have made its people want to stick around. Employee turnover in China was "quite low" last year, according to Qiu.

He is also reaping the benefits of GKN’s positive culture himself, mastering the difficult art of work–life balance.

"I am trying to step back a little in this role," he says. "I try to empower and enable the management of our company to achieve our goals. For critical decisions, I get involved and I am available to support more directly at an operational level."

China’s EV Spike

The appetite for electrified mobility is on the rise in China, with sales of EVs and plug-in hybrids almost doubling in 2022, according to the China Passenger Car Association.

The increase comes even as the overall car sales market suffered while production disruptions and economic challenges took their toll.

The year saw 5.67 million EVs and plug-ins sold nationwide, with sales stoked by state subsidies and high oil prices.

But in most cases, he aims to observe the new wave of talent coming through the organization, and offer his support where necessary.

"I have learned that after the age of 50 years old, we need to empower young talent more rather than engage too much in the day-to-day operations ourselves."

By building on GKN’s capabilities to develop and deliver systems and components that will power the shift to electrification, its China operation looks set to place an increasingly critical role in the company’s future success. And with Qiu blending his own expertise with GKN’s innovative heritage and the huge potential of the Chinese market, it’s an electric future in which it will play a pivotal part.