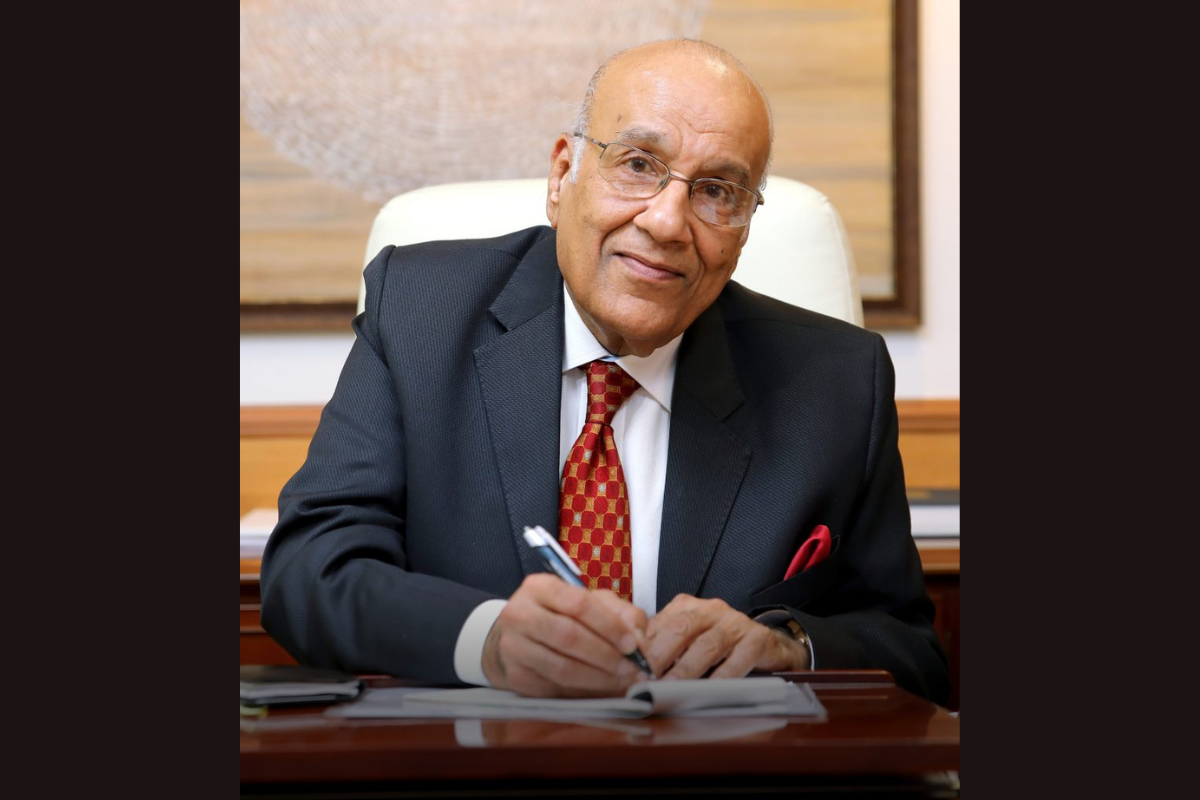

Agriculture of Tomorrow: Saroj Kumar Poddar

Adventz Group Chair Saroj Kumar Poddar has been an entrepreneur for almost 50 years. Far from hanging up his boots, he’s bullish about the Group’s future, especially for its companies working in the agriculture sector.

With pride for his team, Chair Saroj Kumar Poddar credits the success of Adventz Group to its people and their adaptability.

"My group is fully professionalized. We have competent senior professionals running the group and all the businesses that come under it," he says.

"Today, our biggest company is Paradeep Phosphates. We have fully modernized all the grinding units, and now we are expanding its phosphoric acid capacity to soon reach 500 metric tons, making it one of the largest in India."

To achieve this, alongside hiring a high-performing CEO in Suresh Krishnan, Poddar frequently trains, re-trains and holds discussions with employees to bring them up to speed with new technologies.

This professionalism has allowed Adventz to acquire, merge and expand rapidly in the last few decades. Apart from agriculture, the conglomerate has a presence in real estate, infrastructure services and engineering, where it is one of the largest manufacturers of freight cars. Among these, agriculture holds the biggest possibilities, in no small part thanks to the Indian government’s focus and incentives to transform the industry.

Our balance sheets are strong, our ratios are perfect, and finding money to fund this expansion should not be an issue.

Ambitious plans

Adventz’s agriculture wing houses four companies – Zuari Agro Chemicals, Paradeep Phosphates, Mangalore Chemicals & Fertilizers and Gobind Sugar Mills. Among these, Paradeep Phosphates has become a market leader in producing phosphoric acid from phosphate rock, thanks to its vertical integration.

But Poddar has exciting plans for other companies as well, particularly for the Mangalore unit.

"There is potential to do backward integration and put up a phosphoric acid plant in Mangalore and expand the grinding capacity to increase the overall production ability of that unit," Poddar explains.

The plan for Mangalore is an attempt to plug a gap in the Indian market, and then use that foundation to expand into other subsections within the agriculture industry.

"We believe we have a good chance of growing that business because India still imports a lot of phosphates," he says. "The local demand is high. If we can meet our national requirements, we can keep the company in growth mode."

Poddar explains that if Mangalore can be upgraded to an integrated unit like Paradeep, it can help Adventz to expand its market share. In the next phase, Adventz plans to enter crop protection and speciality nutrients as well.

And while ambitious plans often cause companies to face an uphill battle, that’s not the case for Adventz. The agriculture wing is aligned with the national government’s interest in agri-tech, allowing it to use government subsidies to serve more farmers and regions.

Apart from multiple follow-ups with government entities and occasional delayed payments, Poddar sees no challenges worth losing sleep over. He has absolute confidence in the group’s future plans.

"The government is keen on allowing the private sector to grow. Our balance sheets are strong, our ratios are perfect, and finding money to fund this expansion should not be an issue," he says.

The value of partners

Adventz has a rich history of striking up long-term deals with suppliers and working with equity partners to ensure smooth and priority-based deliveries. The best example of this is the partnership with Morocco’s OCP Group, which holds about 70 percent of the world’s phosphate rock deposits.

"Our biggest supplier is our own partner, OCP, which is our single supplier of both phosphate rock and phosphoric acid to us. We have an excellent relationship with OCP, which I believe is the greatest strength of the group," Poddar says.

This has helped Adventz’s fertilizer company avoid disruptions in raw material procurement as it is always given preference.

For Adventz Group, we will always regard farmers as the most important partner in our growth strategy.

However, OCP is not the only key supplier as Adventz needs to procure other products such as DAP fertilizer, sulfur and potash. For this, Adventz floats tenders for equipment and technology partners, and it often works with General Electric, Mitsubishi, Larsen and Toubro and Topsøe.

Alongside these key partners, Poddar believes the Indian government’s involvement in growing the sector and the transparency that comes with it is a key asset. It has enabled the groups’s companies to create consistent value for shareholders and investors over the years.

Despite years of success behind him, Poddar goes to the office with the same passion that started his empire in the early 1970s – the passion of helping Indians.

"For Adventz Group, we will always regard farmers as the most important partner in our growth strategy," he says. "We have to make sure we serve the farmers in their best interest, and that the farmers reap dividends by doing business with Adventz."