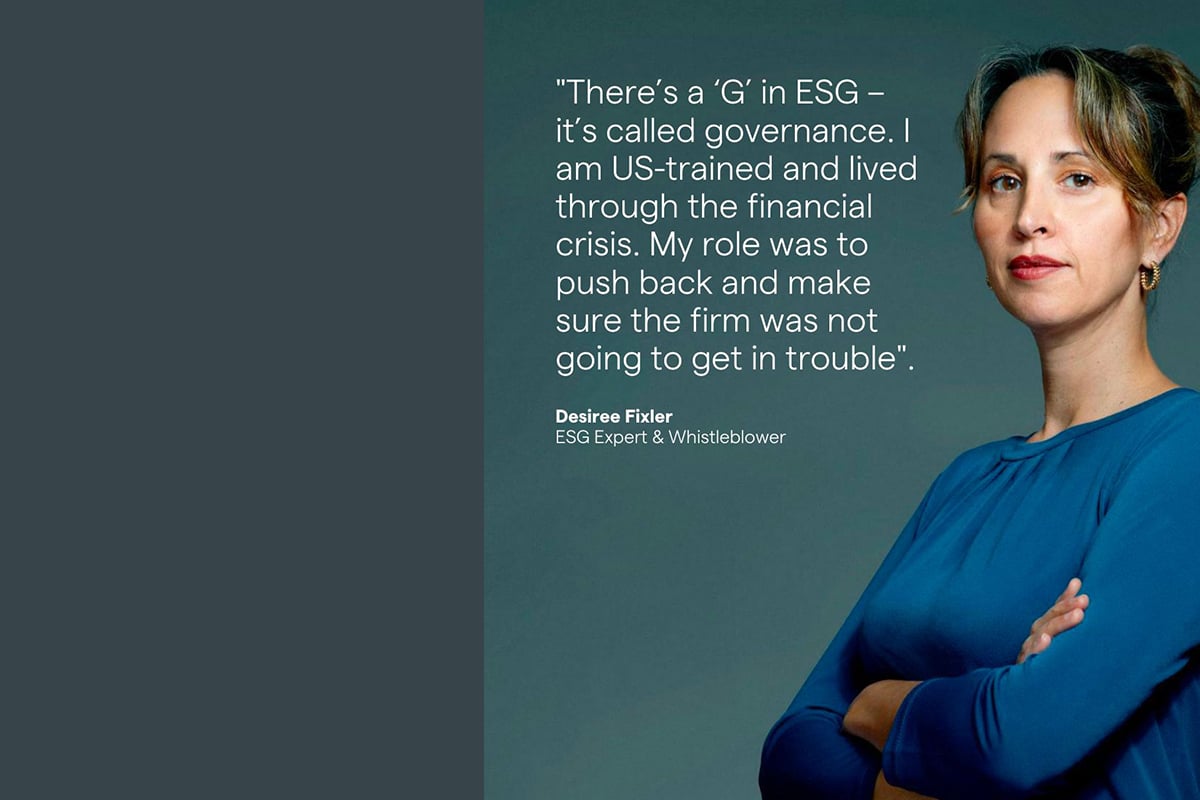

Exclusive interview with ESG expert and DWS whistleblower Desiree Fixler

There’s no shortage of buzzwords in corporate language, yet every good leader knows that talking the talk will only get you so far. All too often terms like ‘diversity’ and ‘inclusion’ get thrown around without giving enough thought to the actions behind them.

As a global collective, we’ve become so accustomed to companies’ environmental claims that it often leaves you wondering how legitimate ambiguous statements such as ‘reducing our carbon intensity’ or ‘decarbonizing our business’ really are.

For red flag detector and ESG advisor Desiree Fixler, making meaningful change starts with evidence-based, honest disclosure.

Candid in her approach to getting to the heart of the matter, the greenwashing detective is well-attuned to pointing out companies’ blind spots.

"If I see some bedazzled sustainability report, that is a huge red flag. It should be a very sober report."

"I come in to help companies internally assess whether they’re inadvertently greenwashing and make the necessary changes," she says. "If I see some bedazzled sustainability report, that is a huge red flag. It should be a very sober report."

However, Fixler wasn’t always a stickler for good governance, responsibility and risk management. It was a book sent to her by a friend that changed the trajectory of her career and her reputation.

"I had been working at J.P. Morgan and a friend of mine, who’s a journalist, sent me a book and it was Banker to the Poor by Muhammad Yunus," she recalls. "She gave me a call and said, ‘Des, you really need to read this because you’re kind of turning into an a**hole’."

It was the catalyst she needed to pivot from traditional investment banking into sustainability and socially responsible investing.

Making global headlines

Fixler’s insights into the true cost of a company’s ESG actions and impact have been hard-earned. It is against the backdrop of the Deutsche Bank subsidiary DWS Group’s greenwashing scandal that she’ll take to the stage at this year’s Purpose Conference held in Sydney.

There, she’ll join a cohort of world-class guest speakers who will be addressing four key themes: regenerative systems, transforming capitalism, responsible tech and climate countdown.

"I’ll speak about the lessons learned from the greatest greenwashing scandal," she reveals. "I will speak about how and why greenwashing came about, ways to mitigate it and how companies can navigate this very challenging market of political rhetoric and regulation on the one hand, and tremendous demand from their customers on the other."

Purpose Conference Founder Sally Hill adds that the two-day business event will put the spotlight on the integrity of ESG claims within the context of businesses taking decisive climate change action.

"You’ve got differing definitions of what ESG means. You’ve got a big anti-ESG political movement, you’ve got increased supervision and regulation, and increased litigation."

"This is not about scaring companies into action but rather protecting those responsible for investing and governance from misleading claims, and ensuring that all of our efforts are translating to meaningful, measurable progress toward decarbonization," she says.

With risk management among the top priorities for CEOs, getting a handle on ESG is as much about protecting a company as it is about navigating a rapidly changing world. In Fixler’s words, it’s a "fractured and confusing market" but that shouldn’t prevent companies from shifting gears.

"You’ve got differing definitions of what ESG means. You’ve got a big anti-ESG political movement, you’ve got increased supervision and regulation, and increased litigation," she reflects.

The companies that are on the right track, Fixler says, are those that have embedded ESG into the business and have invested in upskilling their management teams and boards.

They know that merely hiring a sustainability or ESG specialist or giving too much real estate in reports to a one-off project isn’t progress.

"If it’s off to the side, it’s a sideshow. It’s just a shiny new toy that you’re using for marketing. You can’t adapt your business and just hire academic ESG tree-hugging people," she says.

It’s all about culture

Then there’s a company’s culture, what Fixler refers to as "the cherry on the cake". It is a topic that has personal significance attached to it, as she explains to The CEO Magazine that she was not only publicly fired and discredited, but forced to leave Germany for raising her concerns with DWS Group two years ago.

"That’s why I try and work with other folks that find themselves in a toxic workplace situation or find themselves raising concerns that aren’t being listened to by companies and try and give folks advice," Fixler says.

Since then, she’s been advocating for speak-up cultures, as she believes that employees who have an organization’s best interests at heart are the ones who openly raise their concerns.

The biggest barrier to getting there is a close-knit work culture of similarly minded individuals who value loyalty over expertise, says Fixler. This can be summarized in one word: groupthink.

"They spent tens of millions of euros in defense legal costs. God knows what they spent on PR consultants and incurred opportunity costs because staff had to be diverted to this case."

In DWS Group’s case, shooting the messenger, Fixler, did not work in their favor. By trying to bury her allegations and oust her from the company, the entire incident escalated to a federal police raid, financial losses and a cautionary tale for other companies on what not to do.

"Their market cap dropped approximately 14 percent. That’s over a billion euros. They spent tens of millions of euros in defense legal costs. God knows what they spent on PR consultants and incurred opportunity costs because staff had to be diverted to this case," Fixler says.

"And then, finally, they lost the trust of clients, untold client revenue damage, all because they felt they needed to bury these allegations."

Perhaps the most important takeaway from this exercise in risk management is to address issues not for the sake of establishing right doers from wrong doers, but rather finding a solution.

Fixler quotes Goldman Sachs CEO Lloyd Blankfein: "The best traders are not right more than they’re wrong. They’re quick adjusters. They’re better at getting right when they’re wrong."

From whistleblower to trusted advisor

Now with her portfolio career in full swing, these days Fixler has her hands tied working with academics, regulators, financial institutions and startups. As such, she’s been recognized as one of the Fifty Most Influential in Sustainable Finance 2023.

Her latest project, the ‘Red Flag Greenwashing Indicator’, commissioned by the WWF and co-produced with the University of Zürich and the University of Oxford, is an AI tool that detects greenwashing.

"It is expected to be rolled out by the end of the year, but it is so fantastic and needed by multi-stakeholders," Fixler says.

The London-based American fortunately has a view into the European and United States contexts. Her biggest pain points to date are the pressures on businesses due to over-regulation in Europe and unrealistic expectations from regulators.

"Corporate Sustainability Reporting Directive (CSRD) is forcing companies to create approximately 675 new key performance indicators requiring over 1,000 data points," she says.

"Companies just aren’t set up to do this. I think the regulators got way ahead of what is practical, just disconnected in speaking to companies and this has absolutely overburdened companies here," she says.

Purpose Conference is being held at Sydney’s iconic Carriageworks from 8–9 November. Tickets can be purchased here.